BIR EIS in the Philippines:

Your Complete Guide to the Electronic Invoicing System

Written by 1nvoice.net August 2025

The Bureau of Internal Revenue’s (BIR) Electronic Invoicing System (EIS) is transforming how businesses in the Philippines handle tax compliance. This digital shift began with the TRAIN Law (Republic Act No. 10963), which required companies to move away from paper-based tax reporting and transition into electronic systems.

Since July 2022, the BIR has required the country’s largest taxpayers to adopt e-invoicing for government-related transactions (B2G). This mandate has since expanded to exporters and large enterprises, and by 2026, all large taxpayers must fully adopt the EIS. For businesses, compliance is no longer optional, it’s now a critical step toward modernization, efficiency, and global competitiveness.

What is BIR EIS?

The BIR Electronic Invoicing System (EIS) is a government-mandated platform that automates the issuance, transmission, and archiving of invoices and receipts in digital format. It replaces traditional paper documents such as sales invoices, official receipts, and credit or debit notes with electronic versions that are securely stored and validated by the BIR.

By digitizing invoicing and tax reporting, the EIS ensures greater accuracy, transparency, and efficiency in financial processes. It also helps prevent fraud by standardizing the way businesses issue and report documents. For companies with high transaction volumes or those subject to strict audits, the system provides an easier way to stay compliant while reducing manual errors.

Why the EIS Matters for Businesses?

The shift to electronic invoicing is more than just a government requirement. It provides businesses with long-term benefits. By using EIS, companies can reduce the risks of fraudulent transactions, as every invoice is digitally validated and traceable. It improves efficiency since invoices are processed and submitted in real time, which also accelerates payment cycles and improves cash flow. Compliance with the system helps local businesses align with international standards, making them more competitive in global trade. At the same time, it reduces administrative work, eliminates paper costs, and frees up teams to focus on business growth rather than repetitive manual tasks.

BIR EIS vs. BIR CAS:

Understanding the Difference

BIR EIS Compliance Requirements

To meet BIR standards, businesses must follow these requirements:

1. Electronic Format: Invoices and receipts must be issued in JSON format.

2. Transmission to BIR: All invoices must be transmitted to the BIR within 3 days through API or web service.

3. Secure Storage: Businesses must store invoices and receipts safely for at least 5 years.

Following these ensures not only compliance but also long-term accuracy, efficiency, and audit readiness.

How E- Invoicing Works in the Philippines?

The EIS follows a streamlined process to standardize compliance.

When a business issues an electronic invoice or receipt, the data is converted into JSON format and digitally signed for authenticity.

This information is then transmitted to the BIR through an API. Once received, the BIR validates the submission, either accepting or rejecting it.

Accepted invoices are archived digitally for long-term compliance and audit purposes. This system ensures that every transaction is accurately reported and securely stored.

Achieve Compliance with 1nvoice.net

Achieving compliance with the BIR EIS involves several key steps. Businesses must first register through the BIR EIS portal and configure systems capable of generating and transmitting electronic invoices. Integration with existing ERP or accounting software is the next stage, followed by thorough testing to ensure accuracy and alignment with BIR requirements. Training employees is equally important, as staff must adapt to digital processes and understand how to issue, transmit, and store documents properly. Finally, compliance requires ongoing monitoring.

Companies should stay updated on changes in BIR regulations, regularly update their systems, and maintain strong data security protocols to remain fully compliant over time. With 1Nvoice.net, these steps become seamless, giving you a BIR-accredited solution that automates, integrates, and secures your invoicing process so you can achieve compliance faster and with confidence.

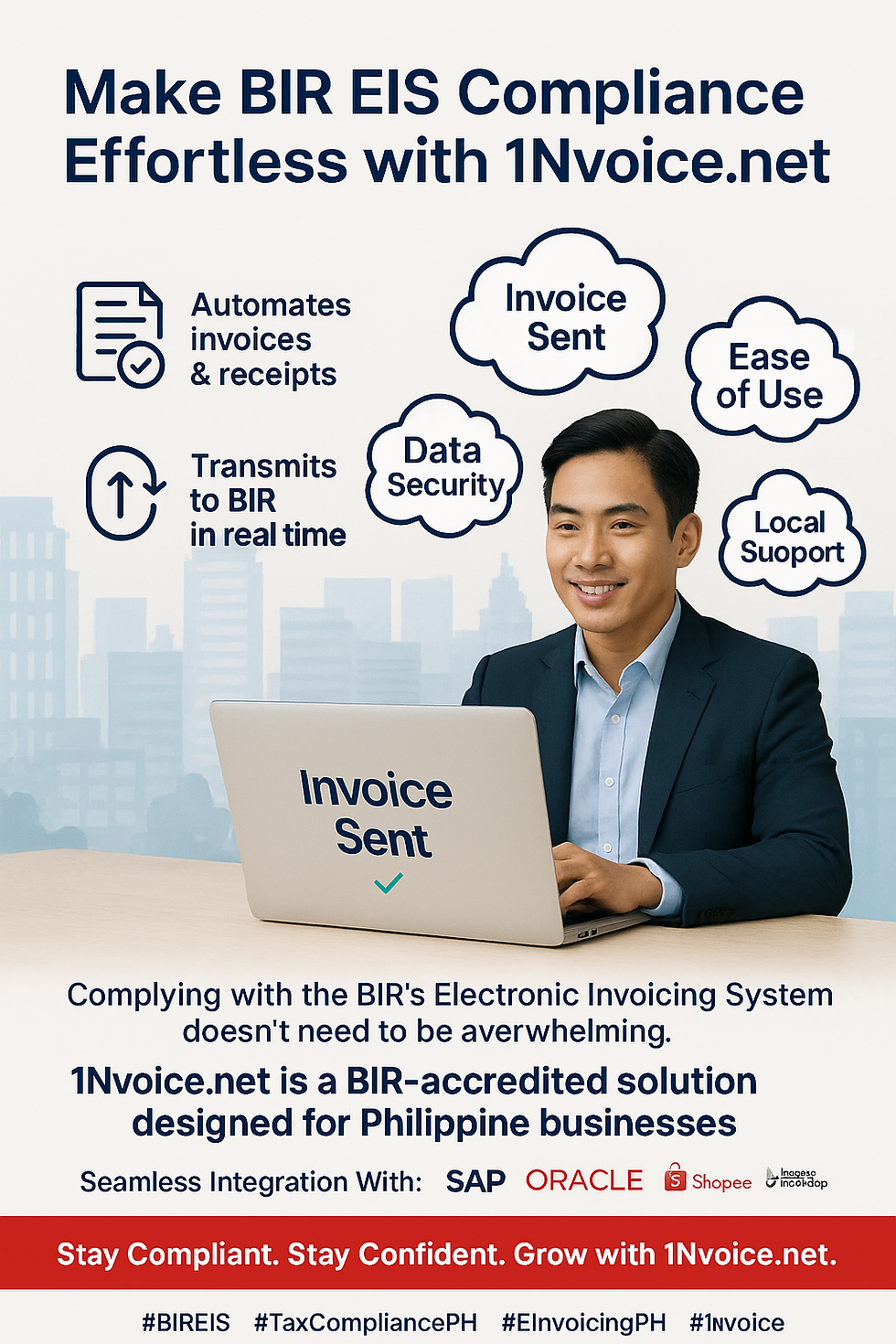

Make BIR EIS Compliance Effortless

with 1Nvoice.net

Complying with the BIR’s Electronic Invoicing System does not need to be overwhelming. 1Nvoice.net is a BIR-accredited solution designed specifically for Philippine businesses. It automates the creation of invoices and receipts, transmits them in real time to the BIR, and securely archives all records for at least five years.

1Nvoice.net is built for flexibility and integration. Whether your company runs on ERP platforms like SAP and Oracle, or sells online through Shopee, Lazada, and TikTok Shop, 1Nvoice connects seamlessly to your existing setup. With its user-friendly design, strong data security, and responsive local support, compliance becomes simple and stress-free. Instead of worrying about audits, penalties, or system backlogs, you can focus on growing your business.

Instead of worrying about audits, penalties, or system backlogs, you can focus on growing your business. If you’re ready to see how it works, book your free demo with 1Nvoice.net today—no obligations, just a clear path to compliance.

Achieving compliance with the BIR EIS involves several key steps. Businesses must first register through the BIR EIS portal and configure systems capable of generating and transmitting electronic invoices. Integration with existing ERP or accounting software is the next stage, followed by thorough testing to ensure accuracy and alignment with BIR requirements. Training employees is equally important, as staff must adapt to digital processes and understand how to issue, transmit, and store documents properly. Finally, compliance requires ongoing monitoring.

Companies should stay updated on changes in BIR regulations, regularly update their systems, and maintain strong data security protocols to remain fully compliant over time. With 1Nvoice.net, these steps become seamless, giving you a BIR-accredited solution that automates, integrates, and secures your invoicing process so you can achieve compliance faster and with confidence.

Achieve Compliance

with 1nvoice.net

How E- Invoicing Works in the Philippines?

The EIS follows a streamlined process to standardize compliance.

When a business issues an electronic invoice or receipt, the data is converted into JSON format and digitally signed for authenticity.

This information is then transmitted to the BIR through an API. Once received, the BIR validates the submission, either accepting or rejecting it.

Accepted invoices are archived digitally for long-term compliance and audit purposes. This system ensures that every transaction is accurately reported and securely stored.

BIR EIS Compliance Requirements

To meet BIR standards, businesses must follow these requirements:

1. Electronic Format: Invoices and receipts must be issued in JSON format.

2. Transmission to BIR: All invoices must be transmitted to the BIR within 3 days through API or web service.

3. Secure Storage: Businesses must store invoices and receipts safely for at least 5 years.

Following these ensures not only compliance but also long-term accuracy, efficiency, and audit readiness.

.png)

BIR EIS vs. BIR CAS: Understanding the Difference

The BIR Electronic Invoicing System (EIS) is a government-mandated platform that automates the issuance, transmission, and archiving of invoices and receipts in digital format. It replaces traditional paper documents such as sales invoices, official receipts, and credit or debit notes with electronic versions that are securely stored and validated by the BIR.

By digitizing invoicing and tax reporting, the EIS ensures greater accuracy, transparency, and efficiency in financial processes. It also helps prevent fraud by standardizing the way businesses issue and report documents. For companies with high transaction volumes or those subject to strict audits, the system provides an easier way to stay compliant while reducing manual errors.

What is BIR EIS?

The Bureau of Internal Revenue’s (BIR) Electronic Invoicing System (EIS) is transforming how businesses in the Philippines handle tax compliance. This digital shift began with the TRAIN Law (Republic Act No. 10963), which required companies to move away from paper-based tax reporting and transition into electronic systems.

Since July 2022, the BIR has required the country’s largest taxpayers to adopt e-invoicing for government-related transactions (B2G). This mandate has since expanded to exporters and large enterprises, and by 2026, all large taxpayers must fully adopt the EIS. For businesses, compliance is no longer optional, it’s now a critical step toward modernization, efficiency, and global competitiveness.

BIR EIS in the Philippines: Your Complete Guide to the Electronic Invoicing System

Why the EIS Matters for Businesses?

The shift to electronic invoicing is more than just a government requirement. It provides businesses with long-term benefits. By using EIS, companies can reduce the risks of fraudulent transactions, as every invoice is digitally validated and traceable. It improves efficiency since invoices are processed and submitted in real time, which also accelerates payment cycles and improves cash flow. Compliance with the system helps local businesses align with international standards, making them more competitive in global trade. At the same time, it reduces administrative work, eliminates paper costs, and frees up teams to focus on business growth rather than repetitive manual tasks.

Choosing the Right E-Invoicing Solution: Practical Advice

Finding the right system isn’t just about compliance—it’s about choosing a tool that makes your business more efficient. Here’s what to look for:

-

BIR Accreditation

-

System Integration

-

Ease of Use

-

Scalability

-

Local Support

-

Data Security

-

Transparent Pricing

By considering these factors, businesses can avoid compliance stress and instead gain a strategic advantage from their e-invoicing system.

Make BIR EIS Compliance Effortless with 1Nvoice.net

Complying with the BIR’s Electronic Invoicing System does not need to be overwhelming. 1Nvoice.net is a BIR-accredited solution designed specifically for Philippine businesses. It automates the creation of invoices and receipts, transmits them in real time to the BIR, and securely archives all records for at least five years.

1Nvoice.net is built for flexibility and integration. Whether your company runs on ERP platforms like SAP and Oracle, or sells online through Shopee, Lazada, and TikTok Shop, 1Nvoice connects seamlessly to your existing setup. With its user-friendly design, strong data security, and responsive local support, compliance becomes simple and stress-free.

Instead of worrying about audits, penalties, or system backlogs, you can focus on growing your business.